Last updated: January 27, 2026

Article

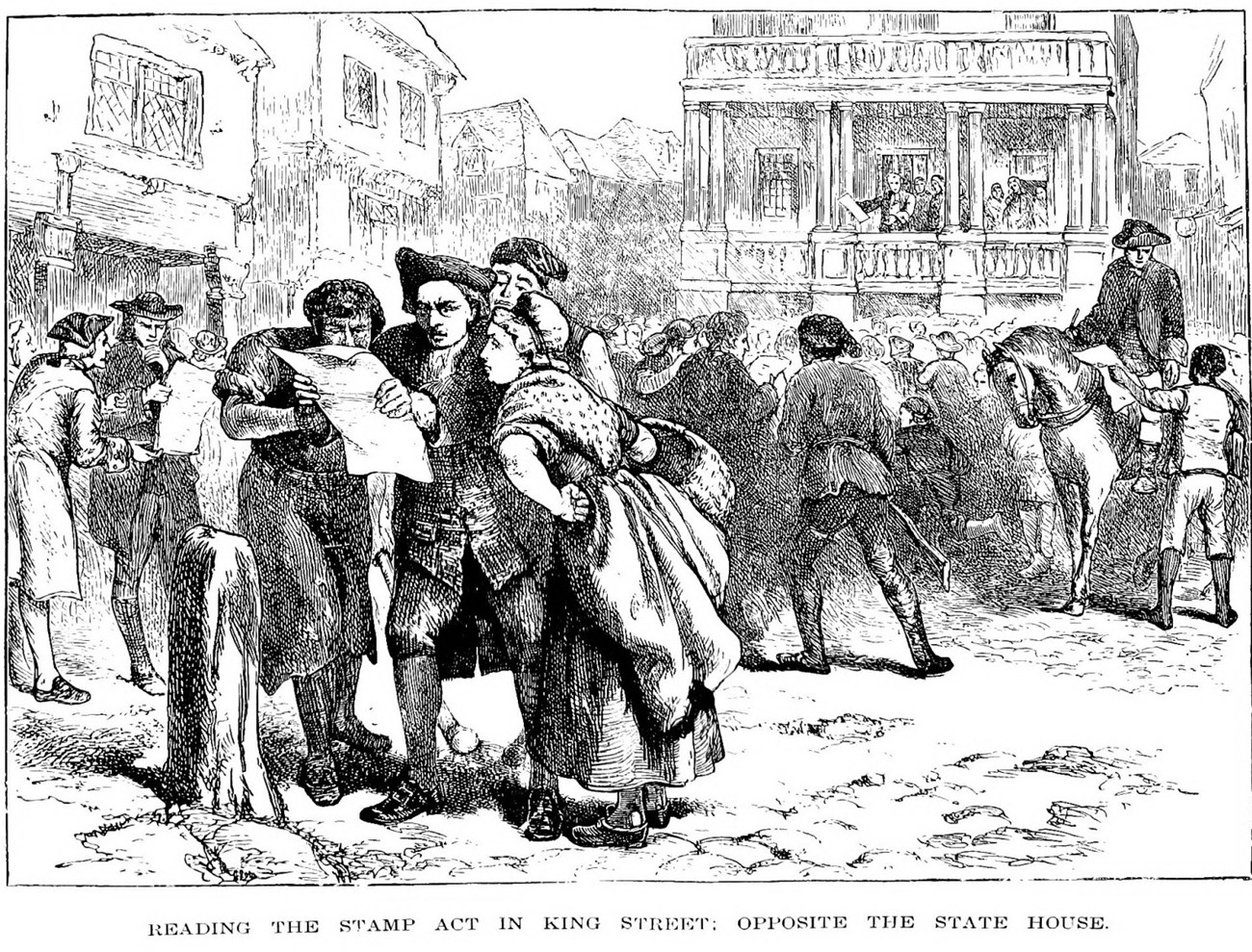

Anger and Opposition to the Stamp Act

In 1763, colonial Britons celebrated victory over France in the Seven Years War. In Boston, proud citizens of the newly-enlarged empire lit bonfires, rang church bells, mustered the militia, and toasted "loyal healths."[1] In 1764, celebration turned to condemnation as Britain began taxing American colonists to pay for their defense. The Sugar Act promised to inflict economic misery and the tyranny of taxation without representation.[2] Prime Minister George Grenville was just beginning to make Americans contribute their fair share.

Creating the Stamp Act

In the summer of 1763, Grenville contemplated a colonial stamp tax, a common form of British taxation dating to 1694. Legal documents, academic degrees, appointments to office, newspapers, playing cards, and dice carried an embossed Treasury stamp to prove payment. While British officials considered colonial stamp taxes in 1722, 1726, 1728, and 1742, they never usurped colonial responsibility for internal taxes.[3]

James H. Stark, "The Loyalists of Massachusetts and the Other Side of the American Revolution" (1907)

Grenville addressed Parliament on March 9, 1764, intent on securing advance support for the unwritten stamp bill. He expressed hope "that the power and sovereignty of Parliament over every part of the British dominions, for the purpose of raising or collecting any tax, would never be disputed." The next day, Secretary of the Treasury Thomas Whately introduced colonial revenue-raising resolutions, including the Sugar Act (passed April 5, 1764). The fifteenth resolution—a stamp tax—was deferred for a year.[4]

As the prospect of a stamp tax hung in the air, Grenville offered to allow the provinces to "among themselves, and in modes best suited to their circumstances, raise a sum adequate to the expense of their defense."[5] However, this offer was, as historian Edmund Morgan observed, "nothing more than a rhetorical gesture…to demonstrate his own benevolence." In a meeting with colonial agents on May 17, 1764, Grenville brushed aside questions about suitable forms of colonial self-taxation. Instead, he asked them to agree in advance to Parliament’s right to tax the colonies, before they had seen a completed stamp bill. Neither he nor the Secretary of State for the Southern Department ever made a formal offer to colonial governors or legislatures about acceptable colonial alternatives.[6] As Benjamin Franklin observed later, Grenville was "besotted with his Stamp Scheme..."[7]

Four days later, Parliament took up the stamp bill. Charles Townsend described Americans as "Children planted by our Care, nourished up by our Indulgence…and protected by our Arms" who should be willing to "contribute their mite [small sum of money]" to relieve Britain of its heavy debt. In severe opposition to this statement, Colonel Isaac Barré thundered:

They planted by your Care? No! your Oppressions planted em in America…They nourished by your indulgence? They grew by your neglect of Em…They protected by your Arms? They have nobly taken up Arms in your defence…[8]

Despite Barré’s words, both Townshend and Barré agreed that Parliament had the authority to tax the American colonies. Grenville and Parliament invoked a long-standing rule that Parliament would not accept citizen petitions against money-related bills, ensuring quick passage of the bill. The Stamp Act passed by a vote of 245 to 49 in the House of Commons and unanimously in the House of Lords. Enacted into law on March 22, 1765, the Stamp Act would take effect on November 1.[9]

Boston printer John Boyle noted the arrival of the Stamp Act on May 14, 1765: "Capt. Jacobson arrived here from London, has bro’t over the Act for levying certain Stamp-Duties in the British Colonies…"[10] Though the Stamp Act expected to bring only a small annual revenue (£60,000), it required payment in specie (hard currency, such as gold or silver). Concern arose amongst colonists who did not have access to hard currency, and they braced for disaster as reports, rumors, and contradictory newspaper accounts continued to swirl.[11]

Economic Impact of the Stamp Act

Daniel Dulany, attorney and member of Maryland’s Proprietary Council, published "Considerations on the Propriety of Imposing Taxes in the British Colonies…" in 1765. Although the pamphlet focused on the unconstitutionality of taxation without representation, Dulany also summed up the Stamp Act’s detrimental economic effects:

…for they [stamp duties] will produce in each Colony, a greater or less Sum, not in proportion to its Wealth, but to the Multiplicity of Juridical Forms, the Quantity of vacant Land, the Frequency of transferring Landed Property, the Extent of Paper Negotiations, the Scarcity of Money, and the Number of Debtors.[12]

Buying and selling land—the main source of colonial wealth—required multiple documents. In this cash-starved economy, mortgages on land—and enslaved people—were a form of credit, along with promissory notes, bonds, and lines of credit with merchants, payable through crops or goods. If debtors defaulted, creditors needed litigation to access their assets. The duties on all these forms would increase the costs of routine legal transactions, especially for lawyers and merchants.[13]

Massachusetts Historical Society

Benjamin Franklin believed the Stamp Act "will affect the Printers more than Anybody," with duties on newspapers, advertisements, pamphlets, and almanacs.[14] In fact, it would affect all ranks of colonial society, from artisans who had to sign indentures with apprentices to tavern owners—many of them women—who had to obtain liquor licenses.[15]

The Stamp Act could also worsen conditions for enslaved people in northern seaports. The post-war depression and the Sugar Act had already resulted in a steep reduction in slave importations and the rise of slave sales.[16] Boston's enslaved population dropped from 1541 in 1752 (one-tenth of the total population) to 811 in 1765.[17]

With these threats to the colonial economy in mind, colonists responded by publishing a deluge of pamphlets, resolutions, and newspaper articles. While pledging loyalty to King and Parliament, authors denied Thomas Whately's contention that American colonists "are virtually represented in Parliament," called for colonial unity, and asked for relief from the "extremely burthensome [burdensome] and grievous" stamp duties.[18]

Violent Opposition to the Stamp Act

Another option existed besides words of protest. When the government and laws did not serve the interests of the people, the people needed to correct those wrongs. A writer in the Boston Post-Boy and Advertiser captured colonial anger to the Stamp Act when he asked:

Will the cries of your despairing, dying Brethren be Music pleasing to your Ears? If so, go on! bend the Knee to your Master Horseleach, and beg a Share in the Pillage of your Country.[19]

By early summer 1765, Boston’s Loyal Nine began planning opposition to the Stamp Act. A group of middling men active in politics, the Loyal Nine included men such as John Avery, Jr., a merchant/distiller and Harvard graduate, and Benjamin Edes, printer of the Boston Gazette. James Otis and John and Samuel Adams probably knew about the Loyal Nine but had no official ties to the organization. The Loyal Nine prepared effigies of stamp distributor Andrew Oliver and George III’s first prime minister Lord Bute. They chose shoemaker Ebenezer McIntosh to execute their plan on August 14, 1765.[20]

McIntosh led 40-50 artisans from the lower ranks, laborers, and mariners to carry the effigies through the streets and hang them from a large elm at Essex and Orange Streets (soon to be known as Liberty Tree).[21] The effigy of Bute, pronounced "boot," was a large boot with the Devil crawling out. A label on Andrew Oliver’s effigy warned: "He that takes this down is an enemy to his country."[22]

At sunset, the group brought the effigies to Oliver’s dock, leveling a building they believed would be the stamp office. Proceeding to Fort Hill, they burned the effigies, which should have ended the protest. However, McIntosh and his less genteel followers continued with their own agenda. They headed to the home of stamp collector Andrew Oliver, brother-in-law to Massachusetts Lieutenant Governor Thomas Hutchinson. They pulled down Oliver’s fences, broke windows, destroyed furniture, drank his wine, and stripped his trees of fruit. Twelve days later, they turned their protest to Hutchinson.[23]

James H. Stark, "The Loyalists of Massachusetts and the Other Side of the American Revolution" (1907).

Protesting Hutchinson and the Stamp Act

Ironically, Hutchinson agreed that Parliament had no constitutional right to pass the Stamp Act and worked towards repeal. But the Boston mob remembered his long history of going against their interests: opposing paper money in the 1740s, trying to abolish the Boston Town Meeting in the 1760s, and simultaneously holding multiple political offices. In their eyes, Hutchinson earned money and status by serving King and Parliament at their expense.[24]

On August 26, 1765, McIntosh's mob first attacked the homes of William Story, deputy register of the Vice-Admiralty Court, and Benjamin Hallowell, comptroller of customs. Then, they unleashed their rage on Hutchinson. Home with his children, Hutchinson escaped with his life as the group advanced on his home. The mob destroyed furniture and tore out windows, partitions, wainscotting, roof tiles, and sawed off part of a cupola atop the mansion. They drank Hutchinson's wine, ruined his garden, stole £900 sterling, and damaged or destroyed thirty years' worth of books and papers collected for his history of Massachusetts. By the time they finished, in Hutchinson's words, "nothing Remained but bare walls and floor."[25]

Even the most ardent haters of Hutchinson and the most ardent lovers of liberty condemned the attack. The Boston Gazette, published by the Loyal Nine's Benjamin Edes and his partner John Gill, warned that "the pulling down Houses and robbing Persons of their Substance…is utterly inconsistent with the first Principles of Government, and subversive of the Glorious Cause."[26]

Violence, intimidation, and a simple "word to the wise" directed at stamp distributors effectively nullified the Stamp Act before it took effect. One by one, twelve of the thirteen stamp distributors for the colonies resigned before distributing stamps.[27]

Responding to this outcry of opposition, the colonies held a Stamp Act Congress in late October 1765 in a display of colonial unity. In their "Declaration of Rights and Grievances," delegates stressed the importance of their trade to Britain, hinting that the "late acts of Parliament…will render them unable to purchase the manufactures of Great Britain." An expansive non-importation movement, essentially a boycott of selected British manufactures, followed. Women played a significant role in this movement, as many women controlled household spending, owned businesses, and created a lot of the American-made goods colonists bought instead of imported goods. The success of the non-importation movement served as an important bargaining chip in achieving the Stamp Act's repeal.[28]

Repeal of the Stamp Act

The Stamp Act’s repeal had to do more with English politics than colonial action. In January 1766, British politician William Pitt emerged as the Parliamentary champion of the American colonists, upholding Parliament’s right to legislate for but not to tax the colonies. He called the Americans "the sons, not the bastards of England" and dismissed virtual representation as "the most contemptible idea that ever entered into the head of a man."[29]

When George III dismissed Grenville as prime minister in July 1765, the Marquis of Rockingham headed a coalition government. Caught between Pitt’s defense of the colonists and Grenville’s defense of Parliament’s unlimited authority over the colonies, the Marquis decided to appeal to both sides. The Stamp Act’s repeal became combined with a Declaratory Act that upheld Parliament’s full authority "to make laws and statutes …to bind the colonies and people of America…in all cases whatsoever." Both laws passed on March 18, 1766. The Declaratory Act passed unanimously; the Stamp Act repeal passed 275-167 in the House of Commons and by a narrow majority of 34 votes in the House of Lords. Though the colonists had won their battle against the Stamp Act, they would soon come to realize that the Declaratory Act held much wider power. But for now, the colonists rejoiced.[30]

Library of Congress

News of the Stamp Act's repeal reached Boston on May 17, 1766: "the Bells in Town were set a ringing…Guns were discharged…and in the Evening were several bonfires." Two days later, the town held a more stupendous celebration. The Sons of Liberty erected an obelisk in praise of liberty on Boston Common, described as "a magnificent Pyramid illuminated by two-hundred-and-eighty lamps." Paul Revere created an engraving of the obelisk to commemorate this symbol of liberty, which was destroyed by a fire during the celebrations.[31]

While the colonists achieved victory in the repeal of the Stamp Act, Parliament's enthusiastic acceptance of the Declaratory Act imperiled colonial liberty and led both sides toward revolution.

Footnotes

[1] Boyle’s Journal of Occurrences in Boston, 1759-1788, New England Historical and Genealogical Register 84 (April 1930): 148-149 (on British victories in Quebec, 1759, and Montreal, 1760), 162 (on peace); Fred Anderson, A People’s Army: Massachusetts Soldiers and Society in the Seven Years’ War (Chapel Hill and London: University of North Carolina Press, 1984), 22-23, on New England pride and quote from John Boyle’s September 16, 1762, account of British victory in Havana.

[2] Jayne E. Triber, A True Republican: The Life of Paul Revere (Amherst: University of Massachusetts Press, 1998), 37-40. Marc Egnal, A Mighty Empire: The Origins of the American Revolution (Ithaca and London: Cornell University Press, 1988), 126-135; Ed., Jack P. Greene, Colonies to Nation, 1763-1789: A Documentary History of the American Revolution (New York: W. W. Norton, 1975), 12-39.

[3] Massachusetts, New York, and Jamaica also passed stamp taxes in the mid-18th century. Edmund S and Helen M. Morgan, The Stamp Act Crisis: Prologue to Revolution (Chapel Hill: University of North Carolina Press, 3rd ed., 1995), 54; Lynne Oats and Pauline Sadler, “Accounting for the Stamp Act Crisis,” Accounting Historians Journal, Vol. 35, Number 2 (December 2008), 108-111; text of Stamp Act https://avalon.law.yale.edu/18th_century/stamp_act_1765.asp.

[4] Morgan, Stamp Act Crisis, 54-56 ; Lawrence Henry Gipson, The Coming of the American Revolution, 1763-1775 (New York: Harper and Row, 1954), 69-71; I. R. Christie, Crisis of Empire: Great Britain and the American Colonies, 1754-1783 (New York: W. W. Norton, 1966), 49-51.

[5] Morgan, Stamp Act Crisis, 54-57; Christie, Crisis of Empire, 51-52.

[6] Christie, Crisis of Empire, 51-52, is more charitable towards Grenville, writing that he “was willing to try the possibility” that the colonies might tax themselves and obtaining prior consent from the colonies “might obviate constitutional objections.” Morgan, Stamp Act Crisis, 59-68, stresses that Grenville had Parliamentary approval to impose a Stamp Act so he did not need colonial consent. Quote on p. 68.

[7] Morgan, Stamp Act Crisis, 65-68; Benjamin Franklin to Joseph Galloway, October 11, 1766, recalling the February 2, 1765, meeting with Grenville, https://founders.archives.gov/documents/Franklin/01-13-02-0164#BNFN-01-13-02-0164-fn-0007.

[8] Morgan, Stamp Act Crisis, 68-70; Gipson, Coming of the American Revolution, 79-80.

[9] Morgan, Stamp Act Crisis, 70-72; Gipson, Coming of the American Revolution, 80-81.

[10] Boyle’s Journal of Occurrences in Boston, 84: 168.

[11] Text of Stamp Act, https://avalon.law.yale.edu/18th_century/stamp_act_1765.asp; Whately, “The Lately Made Concerning the Colonies and the Taxes Imposed Upon Them…”, https://web.archive.org/web/20050223013854/http://www.skidmore.edu/~tkuroda/gh322/Thomas%20Whately.htm; Christie, Crisis of Empire, 53-54; Gipson, Coming of the American Revolution, 79; Morgan, Stamp Act Crisis, 72-73. See articles in Harbottle Dorr Collection of Annotated Massachusetts Newspapers, 1765-1776, I: April-November, when the Stamp Act went into effect. Articles, many of which contained responses from other colonies, continued until news of the Stamp Act’s repeal in March 1766 reached the colonies, https://www.masshist.org/dorr/.

[12] Daniel Dulany, “Considerations on the Proprietary of Imposing Taxes in the British Colonies,” https://www.google.com/books/edition/_/xGsBAAAAQAAJ?hl=en&gbpv=1&pg=PP1, 24.

[13] Land purchases included documents for a land grant, a warrant to survey the property, and to register the title. Justin DuRivage and Claire Priest, “The Stamp Act and the Political Origins of American Legal and Economic Institutions,” Southern California Law Review 88 (2015), 875-912, especially 875-888, 898-912, https://southerncalifornialawreview.com/wp-content/uploads/2018/01/88_875.pdf.

[14] Benjamin Franklin to David Hall, February 14, 1765, https://founders.archives.gov/documents/Franklin/01-12-02-0029; Oats and Sadler, “Accounting for the Stamp Act Crisis,” 124.

[15] DuRivage and Priest, Appendix, 906-912, lists the stamped documents and tax rate, demonstrating the wide impact of the Stamp Act, https://southerncalifornialawreview.com/wp-content/uploads/2018/01/88_875.pdf. On artisans, see Triber, A True Republican, 40-41. In the 1760s, women held 48.3% of tavern licenses in Charleston, South Carolina; 41.6% in Boston, 24.4% in Philadelphia, and 15% in New York, in Benjamin L.Carp, Rebels Rising: Cities and the American Revolution (Oxford and New York: Oxford University Press, 2007), 68.

[16] Gary B. Nash, The Urban Crucible: Social Change, Political Consciousness, and the Origins of the American Revolution (Cambridge and London: Harvard University Press, 1979), 246-256, 320-321.

[17] On population, see Lorenzo Greene, The Negro in Colonial New England (New York: Columbia University Press, 1942), 84-85. On experience of the Black population, see Eric M. Hanson Plass, “So Succeeded by a Kind Providence”: Communities of Color in Eighteenth Century Boston,” M.A. Thesis, University of Massachusetts Boston, 2014, Figures 1 and 2, 58-59, 84; Robert E. Desrochers, Jr., “Slave-For-Sale Advertisements and Slavery in Massachusetts, 1704-1781,” William and Mary Quarterly, 3rd Series, v. LIX, no. 3 (July 2002), 654-664.

[18] On colonial response, see Morgan, Stamp Act Crisis, Chapter 7, and Greene, Colonies to Nation, 45-61. On representation see, Whately, “The Lately Made Concerning the Colonies and the Taxes Imposed Upon Them…” https://web.archive.org/web/20050223013854/http://www.skidmore.edu/~tkuroda/gh322/Thomas%20Whately.htm. and Dulany, “Considerations on the Proprietary of Imposing Taxes in the British Colonies,” https://www.google.com/books/edition/_/xGsBAAAAQAAJ?hl=en&gbpv=1&pg=PP1. On June 8, 1765, the Massachusetts House of Representatives issued a circular letter calling for colonial delegates to convene a Stamp Act Congress in New York the following October. The quote on the “extremely burthensome and grievous” taxes is from “The Declaration of Rights and Grievances,” written by John Dickinson of Pennsylvania, and issued by the Stamp Act Congress, discussed in Morgan, Stamp Act Crisis, 108-119.

[19] Boston Post-Boy and Advertiser, August 26, 1765, in Richard L. Bushman, King and People in Provincial Massachusetts (Chapel Hill, University of North Carolina Press, 1985), 194.

[20] Morgan, Stamp Act Crisis, 126-130; Nash, Urban Crucible, 292-293.

[21] Morgan, Stamp Act Crisis, 130, notes that there were “more genteel members of the mob, disguised in trousers and jackets which marked a workingman.”

[22] Morgan, Stamp Act Crisis, 126-130; Nash, Urban Crucible, 260-262, 292-293; Peter Shaw, American Patriots and the Rituals of Revolution (Cambridge: Harvard University Press, 1981), 15-18. Contemporary accounts in Boston Gazette, August 19 and September 16, 1765, Harbottle Dorr Collection, I: 166, 193, https://www.masshist.org/dorr/. Boyle’s Journal of Occurrences, August 14, 1765, 84: 169. Background in Morgan, Stamp Act Crisis, 130-131.

[23] Contemporary accounts in Boston Gazette, August 19 and September 16, 1765, Harbottle Dorr Collection, I: 166, 193, https://www.masshist.org/dorr/. Boyle’s Journal of Occurrences, August 14, 1765, 84: 169. Background in Morgan, Stamp Act Crisis, 130-131. For more on the relationship between Revolutionary leaders and the “lower sort,” see Dirk Hoerder, “Boston Leaders and Boston Crowds, 1765-1775," in Ed., Alfred F. Young, The American Revolution: Explorations in the History of Radicalism (DeKalb, Illinois: Northern Illinois University Press, 1976), 233-271.

[24] Nash, Urban Crucible, 226-227, 271-281; Bernard Bailyn, The Ordeal of Thomas Hutchinson (Cambridge: Belknap Press, 1974), 64-69.

[25] The best description is in Hutchinson’s letter to Richard Jackson, August 30, 1765, https://www.colonialsociety.org/node/2532#chsect1705. See also, Morgan, Stamp Act Crisis, 131-134, Nash, Urban Crucible, 294.

[26] Boston Gazette, September 2, 1765, Harbottle Dorr Collection, I: 177, https://www.masshist.org/dorr/.

[27] Morgan, Stamp Act Crisis, Chapter 9 (“Contagion and Resignations”).

[28] Morgan, Stamp Act Crisis, 107-119. On non-importation, which continued throughout the Revolutionary era, see Nash, Urban Crucible, 354-371, passim.

[29] Morgan, Stamp Act Crisis, Chapter 15; Greene, Colonies to Nation, 65-66, 68-72.

[30] Greene, Colonies to Nation, 65-85; Christie, Crisis of Empire, 55-64.

[31] On celebration of repeal, Boston Gazette, May 19, 26 1766, Harbottle Dorr Collection I: 411, 412, 415.