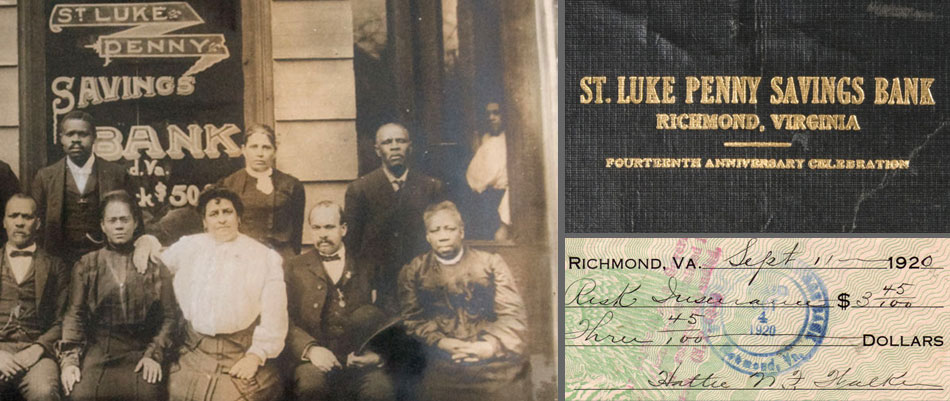

St. Luke Bank

“Let us have a bank that will take nickels and turn them into dollars”

Maggie L. Walker, 1901 in an address to the members of the Independent Order of St. Luke at the 34th Annual Session of the Right Worthy Grand Council of Virginia.

Mrs.

Walker strengthened her banking, accounting, and business skills by studying prominent banks in Richmond, VA. She recruited Emmett Burke, head teller, from the True Reformers Bank, the first African American bank chartered in the U.S. With all the pieces in place, Mrs. Walker opened the St. Luke Penny Savings Bank to an expectant crowd on the first floor of her St. Luke Hall on November 2, 1903. The bank’s prospects were promising as it opened with over $9,000 in deposits on its first day of business. By January of 1906, savings deposits totaled $170,000, providing opportunities for home and business loans. By 1920, the bank had financed over 600 home loans, allowing for significant real estate holdings in Richmond’s African American residential community. More...

Financial security and investment was not just for the elite business class. Like Mrs. Walker's mother, most female account holders were in domestic service, including laundry. Walker's vision for the bank included multiple branches in Virginia as well as a branch in Washington, DC. However, only a branch in Hampton, Virginia became a reality. From 1905 to 1911, Mrs. Walker ran her bank as a joint venture inside the St. Luke Emporium on Richmond's Broad Street. In 1911, regulations restricting fraternal orders' operation of banks and businesses forced the bank to find a separate location a block away at 1stS and Marshall Streets. Mrs. Walker commissioned noted African American architect Charles Russell to construct a new building where business continued at a steady rate. To avoid the catastrophic fallout from the 1929 stock market crash, Mrs. Walker merged the St. Luke Bank with two other black banks, the Commercial Bank and Trust Company and the Second Street Savings Bank. With its pooled assets and Walker's continued leadership, the new Consolidated Bank and Trust survived the Great Depression and prospered as a local bank in Jackson Ward until 2011.